Factors Influencing Bank Selection by a Gen-Z

By Jacqueline Berkoff, Assistant Project Manager

My Story

As a recent college graduate who is just starting out a new job in New York City, I wanted to explore what banks have to offer me and evaluate the reasons why I would choose certain banks over others. In other words, what factors would encourage or deter someone like me, a Gen-Zer, to open an account at a bank? I walked into eleven different bank branches in the immediate neighborhood of the MKP office with the idea that I wanted to open new checking and savings accounts.

Methodology

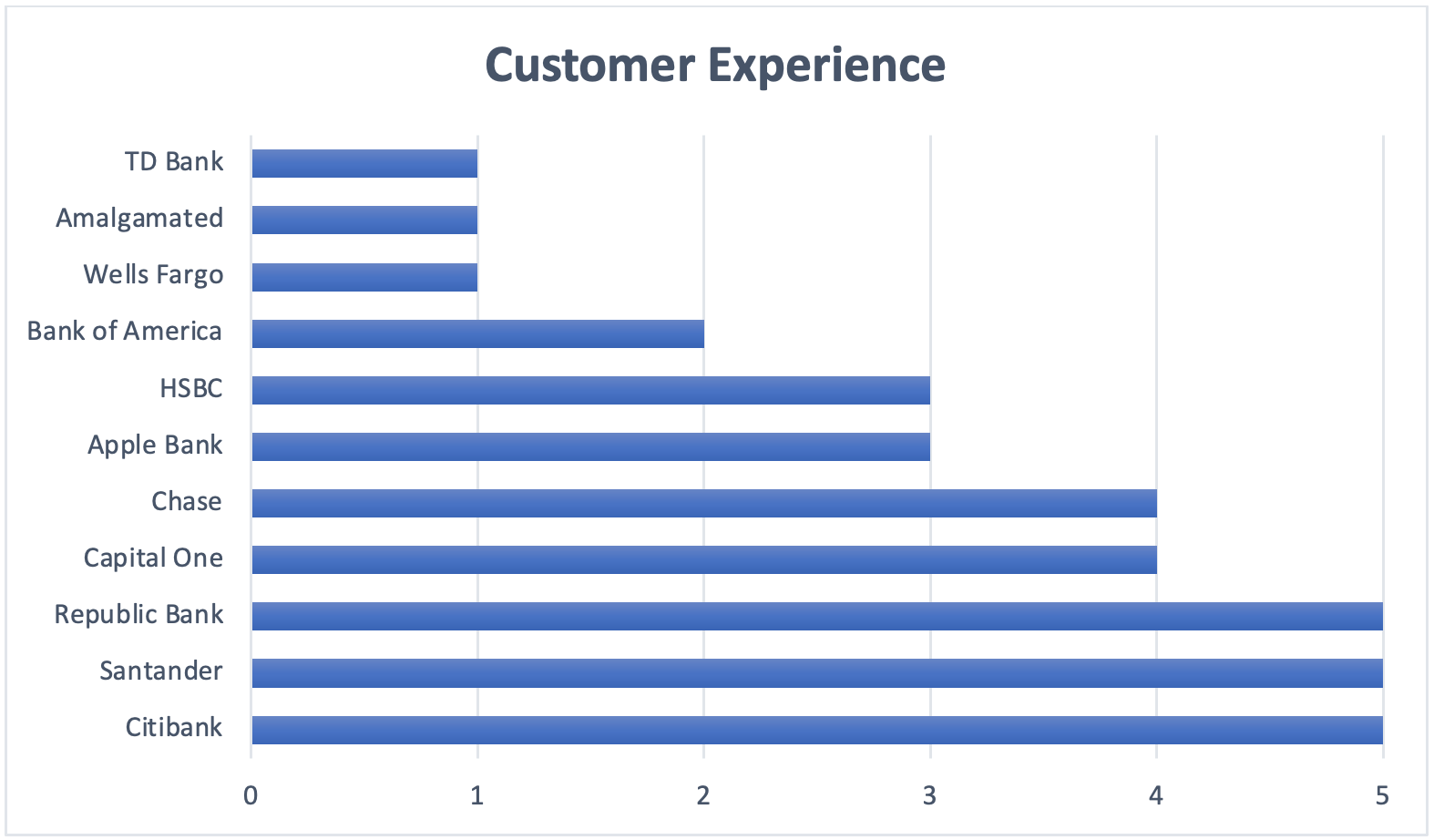

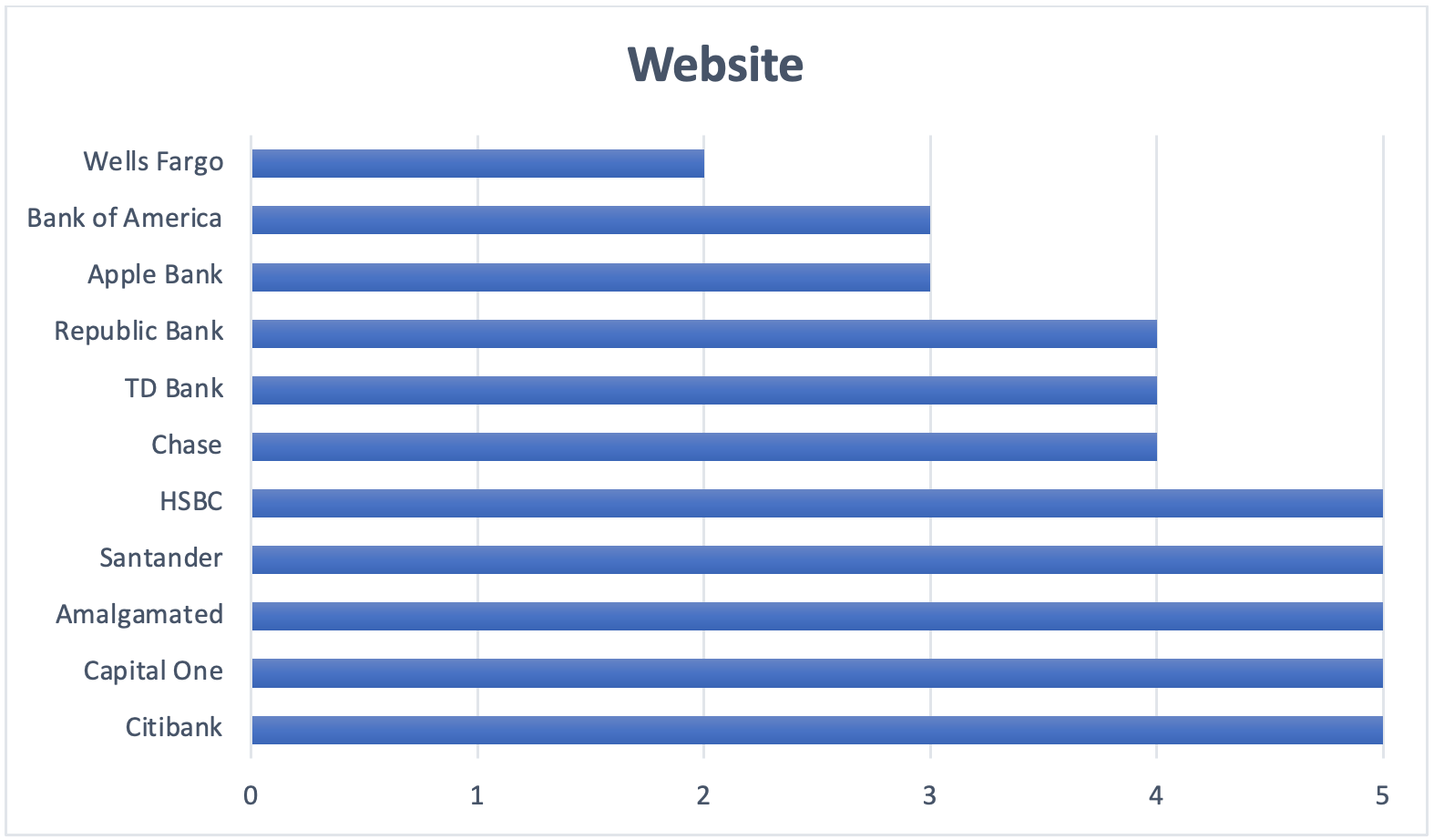

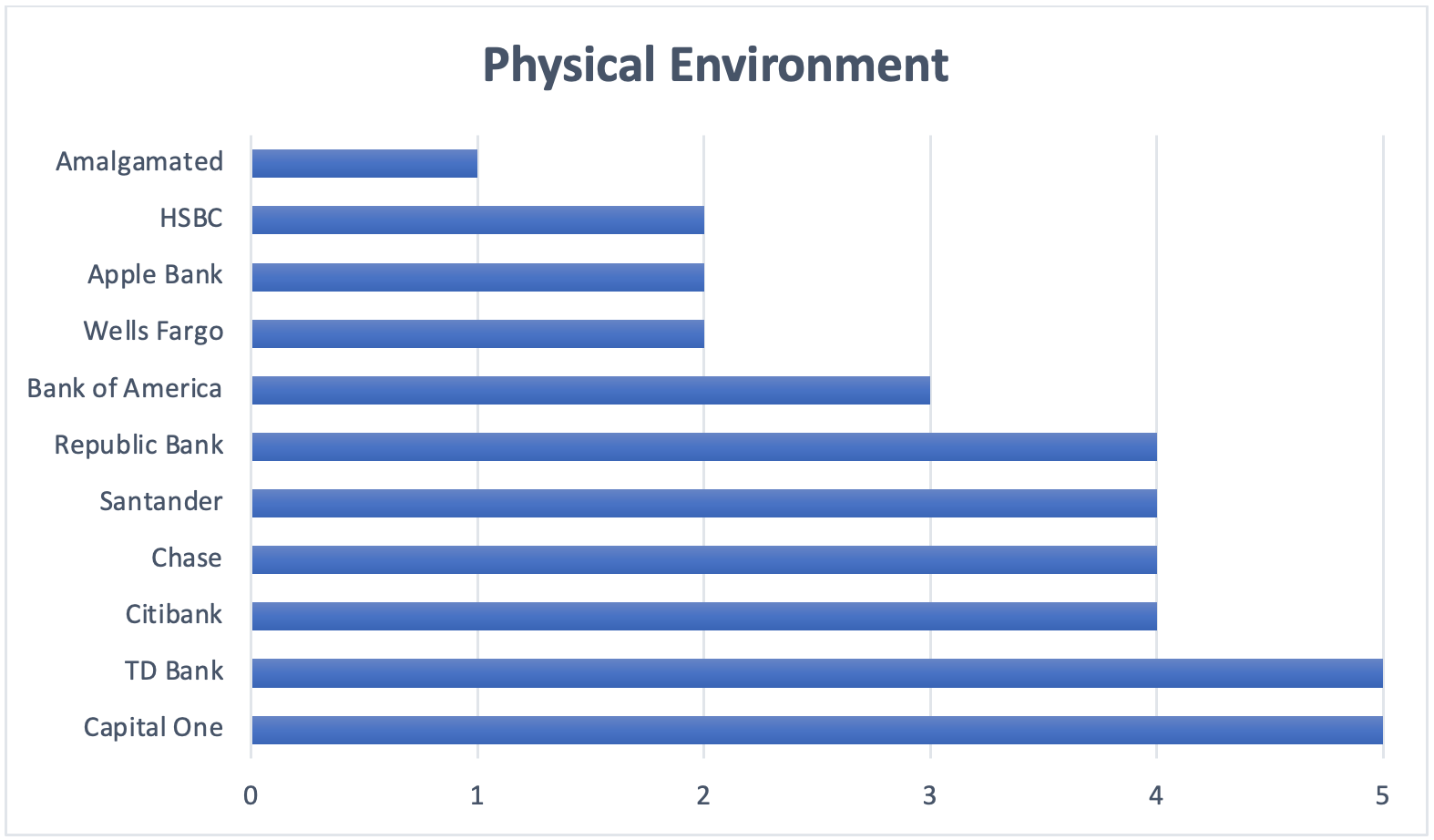

I ranked each of the 11 banks on a scale of 1 to 5 for each of these three factors: customer experience, website and physical environment (with 5 being the best score).

Overall Evaluation

Of the three factors, ultimately customer experience was the most influential in determining my overall rankings. This is because most banks offer similar experiences among their products, branches and websites, whereas customer experience proved to be the main differentiator for me. The highest ranked banks thoroughly addressed my needs, showed interest in me as a person, and made me feel like they genuinely cared about me.

Bank websites were the second most important factor I took into account because of how prominent online banking has become. Two of the most important factors I took into account when ranking bank websites were whether they were attractive and user-friendly.

The physical environment of each branch had the least impact on whether I would open an account with a bank because most, if not all, banking can now be done online. Nevertheless, I ranked the most visually appealing branches the highest in this category. You might notice that I didn’t consider products as a factor when choosing a bank. There isn’t much diversity in checking and savings products from bank to bank; therefore, this didn’t influence my decision-making.

My Top Three

Republic Bank was a favorite of mine solely because of their customer service. While their branch and website were extremely ordinary, I still liked this bank the most because of the interaction I had with their employee. I really appreciated that he made it a point to get to know me on a deeper level rather than just use surface level small talk. This left a lasting positive impact on my overall impression of the bank.

I felt that Citibank was very professional and provided great customer service. Although I think Citibank appeals to businesses and professionals more than to everyday people like me, I would still highly consider opening an account here due to the fact that I received amazing customer service. When I told an employee that I wanted to open an account, she took me into her office, made some small talk to show interest in me, and presented me with a brochure where she thoroughly explained each product and wrote some helpful notes.

Santander did not only have a welcoming physical environment and excellent website, but they also had amazing customer service. I was given undivided attention by an employee who seemed like she really wanted to help me. We were close in age and she told me about her experience opening up a bank account, which made her relatable. It reduced the barrier between employee and customer, which I appreciated.

Of the top three banks ranked in this category, Republic Bank still left the biggest impression on me. The employee at Republic Bank turned his attention to me immediately, even though it looked like he was working on something before I walked in. A big difference I noticed was that other bank employees would rush through the description of products, while the Republic employee really took his time to explain the pros and cons of each product to me. I also noticed that other banks would ask me surface level questions to understand which tiers of checking and savings accounts I qualified for, but the Republic employee took the time to ask me real questions about myself, and he seemed genuinely curious about the answers.

Unfortunately, throughout my search, I came across banks that seemed to value customer experience less, leading me to feel unimportant. When I walked into TD Bank, I was greeted by their security guard. When I told her that I wanted to open checking and savings accounts, she started telling me what they have to offer. Although the security guard was very nice, I found it strange that I was hearing about the bank’s products from her instead of from a TD Bank employee. When I asked for more information, the security guard informed a TD Bank employee that I was looking to open an account. This employee then asked the security guard to give me a brochure. This left a bad taste in my mouth because it meant that a TD Bank employee knew I was interested in opening an account with them and still allowed the security guard, who was not a professional banker, to be my only point of contact.

The bank websites that went above and beyond my expectations were not only attractive and user-friendly but also tremendously resourceful. I really enjoyed browsing the Citibank website because it was simple and clear, and it also had interesting and attention-grabbing visuals. Capital One’s website also had a great feature where you can fill in the blanks of the sentence, “I want to ___ so that I can ___”. I chose “grow my money” and “buy a car”, which led me to several articles on how to get a car loan, estimate car payments, etc. I think this is an amazing feature for someone like me because I still have a lot to learn about topics like these.

Although Wells Fargo’s website was easy to navigate, the design was unembellished and bare. Most of the pages were filled with a lot of small text, which deterred me from reading the information provided. The personal banking page did provide me with a chart that compared all the different types of checking and savings accounts they offer, but it appeared as if they had just typed the information onto the page. It wasn’t presented in an organized or visually appealing manner. Having a user-friendly website can only get you so far if you can’t engage customers with the information presented.

I found that the banks I ranked highest for having the most appealing physical environments did not look like typical banks. For example, as soon as I walked into Capital One, I heard upbeat music and saw a lot of bright accent colors on the beautifully designed wooden walls. This instantly generated an energetic and fun environment. A lot of the customers there seemed to be around my age, which made me feel like I belonged. They also had a coffee shop located inside, which added warmth, and I found to be distinctive and refreshing. In a generation that is constantly exposed to media and design, the design of this space really resonated with me.

On the other hand, the appearance of another bank I visited left a negative impression on me. The entrance to Amalgamated Bank is through a bright orange room with only two ATMs. I thought the interior of the bank was very strange. The walls were brick, the furniture was all wooden, and the ceiling was metallic silver. This overwhelming combination of differing designs left me feeling unsettled and drew my attention away from the purpose of my visit. I did, however, like the posters they had inside the branch that highlighted Amalgamated’s effort to work with positive change-makers.

Conclusion

Going into this, I truly thought that the bank websites were going to be the most influential factor in choosing a bank. Being a Gen-Zer, I really value technology and don’t necessarily seek out human interactions the way that older generations typically do. For example, when I go to the grocery store, I choose the self-checkout instead of going to a cashier. So, it shocked me that I ultimately felt that customer experience was the most important factor when choosing a bank. Generally, all banks offer almost identical products, their branches are relatively similar and their websites are, for the most part, user-friendly. I think this is why customer experience stood out as a true differentiator and why it had such an outsized impact on my impressions.

MKP communications inc. is a New York City-based communications company specializing in financial services marketing and merger/change communication.